A cash flow statement is one of the basic financial sheets of any business or project. While a cash flow statement shows the cash inflow and outflow of a business free cash flow is a companys disposable income or cash at hand.

How To Calculate Free Cash Flow Fcf With Example Under Controlling

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-b54b46188f5746769a37298478048177.jpg)

Free Cash Flow Fcf Definition

Operating Cash Flow Capital Expenditure and Net Working Capital.

Free cash flow formula. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Cash Flow Coverage Ratio EBIT depreciation amortization Total Debt. Free Cash Flow Formula.

Free cash flow yield is a financial ratio that standardizes the free cash flow per share a company is expected to earn as compared to its market value per share. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures. The listing shown below acts as a quick reference to.

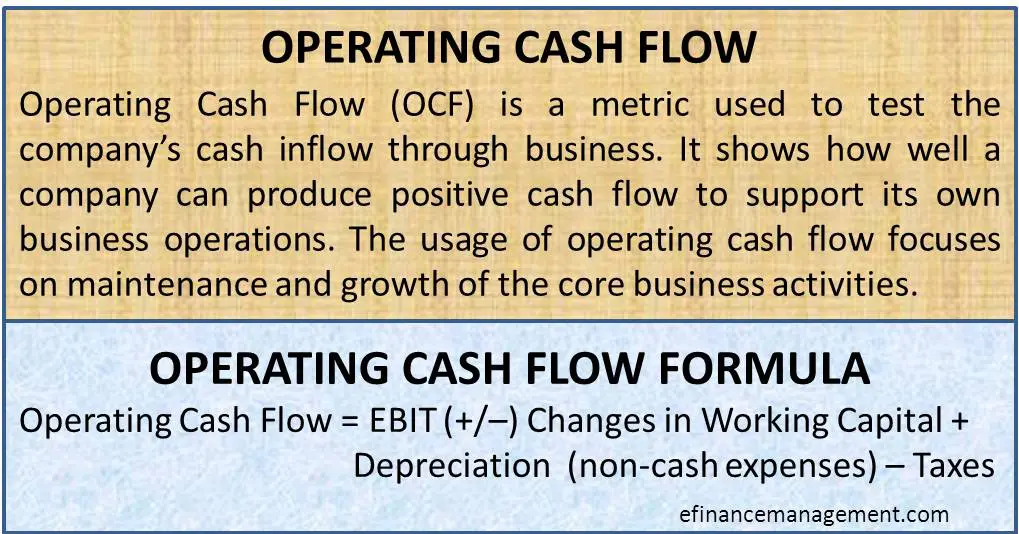

Following is the formula. So the net cash flow is calculated to reconcile the cash on hand at start and cash on. Operating cash flow formula.

The more free cash flow a company has the more it can allocate to dividends. This formula is simple to compute and its often ideal for smaller businesses partnerships and sole proprietors. Let us take the example of Walmart Inc.

A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. To see the calculation. Cash flow is the lifeblood of your business.

In fact according to Jessie Hagen of US Bank when businesses fail for financial reasons poor cash flow is to blame 82 of the time. As you can see the free cash flow equation is pretty simple. You need to provide the three inputs ie.

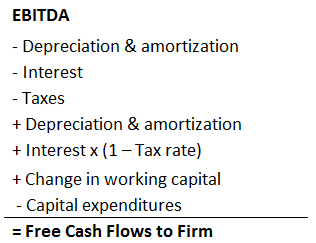

If we start the calculation from EBITDA the minor difference is that DA is subtracted and then added back later and so the net impact is the tax savings from the DA. The generic Free Cash Flow FCF Formula is equal to Cash from Operations Cash Flow from Operations Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time. Article Link to be Hyperlinked For eg.

It is the leftover money after accounting for your capital expenditure and other operating expenses. Net cash flow illustrates whether a. What is the Free Cash Flow FCF Formula.

And when it stops moving rigor mortis sets in. Net cash flow illustrates the amount of money being transferred in and out of a businesss accounts. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures.

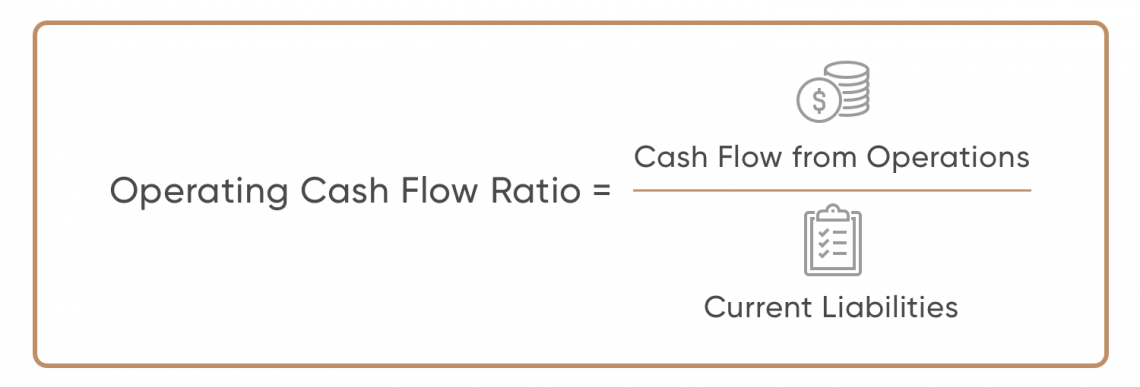

In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed in financial economics. You can easily calculate the Free Cash Flow using the Formula in the template provided. Cash Flow Coverage Ratio Operating Cash Flows Total Debt.

Calculating free cash flow to the firm can get a little tricky as the formula is a little lengthy and requires strong analytical skills. It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its operations. To illustrate the computation of the cash flow formula.

Free Cash Flow to Firm FCFF. Total revenue operating expenses OCF To use the direct method use total revenue and total operating expenses posted to the income statement. Free Cash Flow 93 million.

Consider this an anatomy lesson for your business. While a traditional cash flow statement like the kind you can get from Wave reports gives you a picture of your business cash at a given time that doesnt always help with planning and budgetingbecause it doesnt truly reflect the cash you have available or free to use. A formula for Free Cash Flow to the Firm.

Further it maintains the record of all the financial cash inflows and cash outflows for a particular time. Using the direct method the cash flow from operating activities is calculated using cash receipts from sales interest and dividends and cash payments for expenses interest and income tax. Free Cash Flow Formula in Excel With excel template Here we will do the example of the Free Cash Flow Formula in Excel.

Net Cash Flow vs Free Cash Flow. Formula from EBITDA EBITDA FCFF. Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018.

The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. Free Cash Flow to the Firm Net Income Non-cash Charges example depreciation and amortization Interest 1-Tax Rate. It is very easy and simple.

Another way to figure cash flow coverage ratio is to add in depreciation and amortization to earnings before interest and taxes EBIT first. Cash Flow Formula Example 2. The OCF portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from EBITDA.

You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution. Operating activities include generating. Free cash flow helps companies to plan their expenses and prioritize.

That makes cash flow a much more comprehensive view of a companys financial wellbeing. FCFF Free cash flow to firm also known as unlevered cash flow is the cash remaining with the company after depreciation taxes and other investment costs are paid from the revenue and it represents the amount of cash flow that is available to all the funding holders be it debt holders stock holders preferred stock holders or bond holders. Now lets see an example of this calculation at work.

Free cash flow formula One of the most common and important cash flow formulas is free cash flow or FCF. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Plan Projections

Operating Cash Flow Ratio Definition And Meaning Capital Com

Free Cash Flow Valuation Online Presentation

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Formula Calculation With Examples

Free Cash Flow To Firm Fcff Formulas Definition Example