Figure 121 Examples of Cash Flows from Operating Investing and Financing Activities shows examples of cash flow activities that generate cash or require cash outflows within a period. Balance cash flow and liquidity.

Guide To Cash Flow Statements Enkel Backoffice Solutions

Cash Flow From Investing Activities Formula Calculations

Cash Flow Cf Definition Investing Com

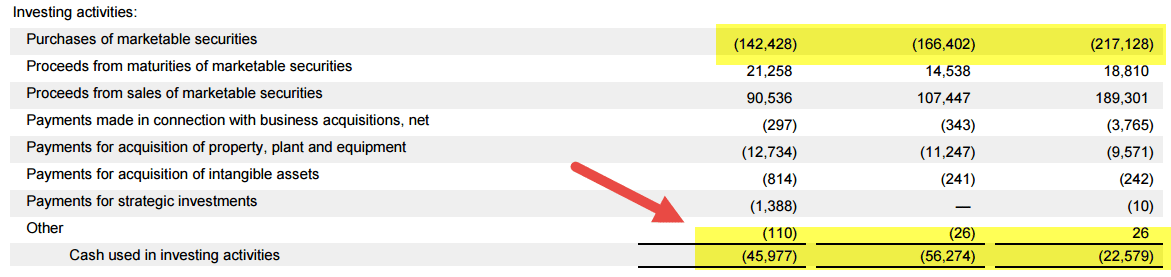

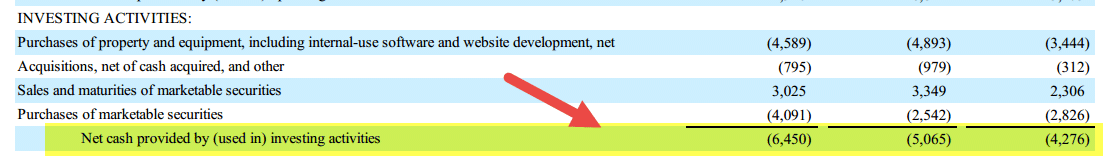

Cash flow from investing activities - the amount of cash generated from investing activities such as purchasing physical assets investments in.

Investing cash flow. Investing activities include purchase and sale of long term assets and other investments. Stock investing for cash flow summary. Of cash flow statement is to provide useful information about cash flows inflows and outflows of an enterprise during a particular period under various heads ie operating activities investing activities and financing activities.

Cash flow from Investing Activities is the second of the three parts of the cash flow statement that shows the cash inflows and outflows from investing in an accounting year. There is a lot more to this trade. Annual cash flow by MarketWatch.

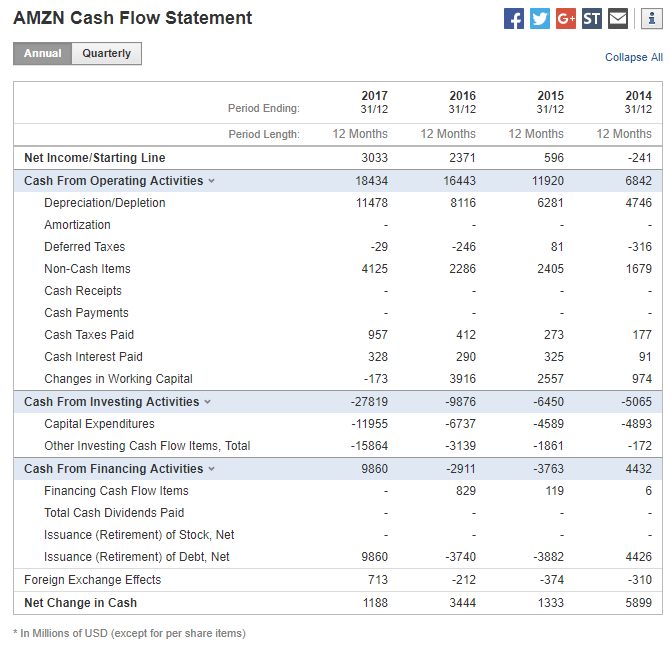

Investing activities includes cash flows from the sale of fixed asset purchase of a fixed asset sale and purchase of investment of business in shares or properties etc. View AMZN net cash flow operating cash flow operating expenses and cash dividends. But make sure to have enough liquid assets to cover ongoing expenses.

Cash flow from investing activities is the cash that has been generated or spent on non-current assets that are intended to produce a profit in the future. On MSN Money Cash Flow Statements are located at Financial Results Statements Cash Flow. The formula for net cash flow can be derived by adding cash flow from operations cash flow from investing and cash flow from financing.

Cash outflows are generated from investments in long-term assets and other investments include property plant and equipment. However some non-cash investing and financing activities may be much important for the users of financial statements because they may have a significant impact on the current and future performance in terms of revenues profits and the. I would love to show you how to calculate the risks on a risk graph so you can go into trades like this one with enormous confidence.

Usually they are the long-term assets of the companys balance sheet. The cash flow statement shows all long-term investing activities and how well cash is being managed. Using the research tool of your choice locate historical Cash Flow Statements going back 10 years if possible.

Mathematically it is represented as. View TSLA net cash flow operating cash flow operating expenses and cash dividends. Cash and cash equivalents of an entity by means of a cash flow statement which classifies cash flows during the period from operating investing and financing activities.

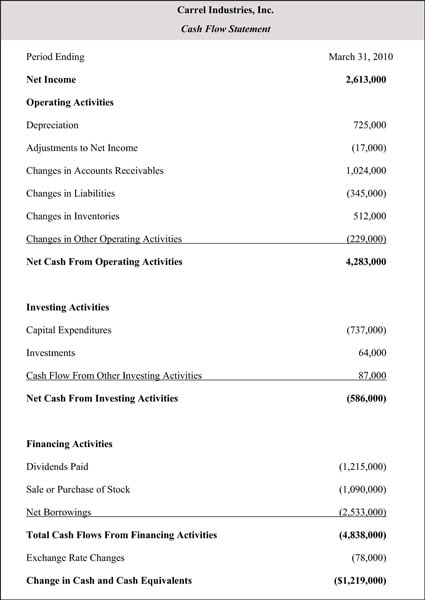

Cash Flow from Investing Activities is the section of a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. This was primarily due to reduced capex Capex Capex or Capital Expenditure is the expense of the companys total purchases of assets during a given period determined by adding the net increase in. The cash flow statement compiles all of the income and expenses for a specified period and reveals the resulting net cash flow from operating investing and financing transactions.

In financial accounting a cash flow statement also known as statement of cash flows is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activitiesEssentially the cash flow statement is concerned with the flow of cash in and out of the business. Cash flow from investing activities includes inflow and outflow of cash in investing activities. The money moving between a company and its owners investors and creditors are called the financing cash flow.

An entity which prepares and presents financial statements under the accrual basis. Both long-term and short-term investments in equity and debt issued by. Cash flow statement is to provide useful information about cash flows inflows and outflows of an enterprise during a particular period under various heads ie operating activities investing activities and financing activities.

Here are some examples of investment activities to track. Investors earlier use to look into the income. The purchase or sale of a fixed asset like property plant or equipment would be an investing activity.

For the Cash from Operating Activities value use the appropriate number from the line Cash from Operating Activities. The cash flow from investing activities is derived by adding all the cash inflows from the sale or maturity of assets and subtracting all the cash outflows from the purchase or payment for new fixed assets or investments. But a single blog post is a tough place to teach.

The cash flow generated from investing activities is termed as investing cash flow. Cash Flow from Investing Activities Box Cash Flow from Investing activities was at -757 million in 2016 as compared to -8086 million in 2015. To calculate investing cash flow add the money received from the sale of assets and any amounts collected on loans and subtract the money spent to buy assets and any loans made.

Statement of cash flows reports only those operating investing and financing activities that affect cash or cash equivalents. Real cash flow can be useful for analyzing a companys current cash flow in relation to the past. That displays how much money has been used in or generated from making investments during a specific time period.

Annual cash flow by MarketWatch. It can include assets equipment acquisitions and equity. Consider categorizing your needs as shorter- and longer-term as a way to manage cash flow.

Cash flow from investing activities involves long-term uses of cash. Using this information the net cash inflow and outflow can help calculate net cash flow. Operating cash flow indicates whether a company can produce sufficient cash flow to cover current expenses and pay debts.

Figure 122 Examples of Cash Flow Activity by Category presents a more comprehensive list of examples of items typically included in operating investing and financing sections of the statement of cash flows. Cash flow arising from Investing activities typically are. For example lets say that a certain company had cash flow of 10 million in 2000 and expects.

Holding too much cash may mean you miss out on investing opportunities. The net cash flow is also the difference between the opening cash balance and the closing cash balance of a reporting period.

12 1 12 Statement Of Cash Flows 12

Cash Flow From Investing Activities Msrblog

How To Read A Cash Flow Statement Wall Street Survivor

Negative Cash Flow Investments In Companies

Cash Flow From Investing Activities Double Entry Bookkeeping

Cash Flow From Investing Activities Formula Calculations

How To Use A Cash Flow Statement When Making Investment Decisions Dummies

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities