1 2000 Lay established two program sales plans under Commission Rule 10b5-1. Key employees or executives who have access to the strategic information about the company use the same for.

Insider

Insider Trading Types It Leads To Example Investigation Prosecution

/GettyImages-1141708100-fbc532e65f1248ba9e5118aa2f5359e4.jpg)

What Investors Can Learn From Insider Trading

A non-fungible token NFT is a unique identifier that can cryptographically assign and prove ownership of digital goods.

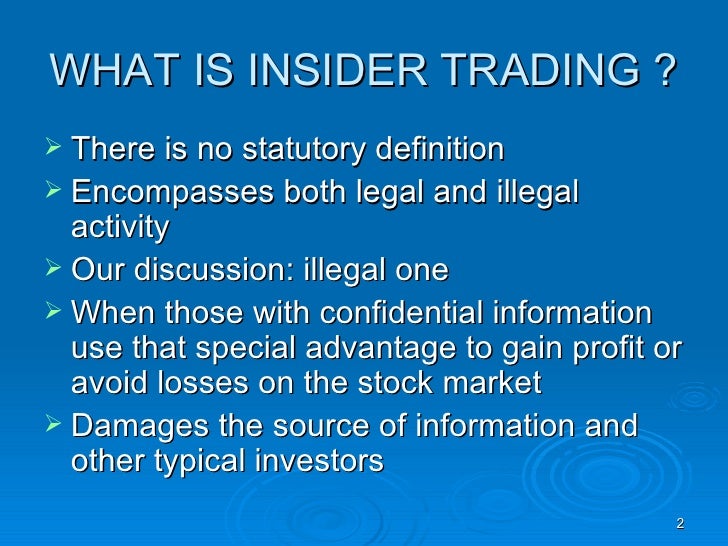

Insider trading meaning. 291 enacted April 4 2012 is an Act of Congress designed to combat insider tradingIt was signed into law by President Barack Obama on April 4 2012. Of something unpleasant or dangerous gradually and secretly causing harm. Neither the insider trading compliance program nor the potential liability under Rule 10b-5 impose a substantial risk of forfeiture on the Y shares acquired by Q because the provisions of the program and Rule 10b-5 do not condition Qs rights in the shares upon anyones future performance or refraining from performance of substantial services or on the occurrence of a condition related to.

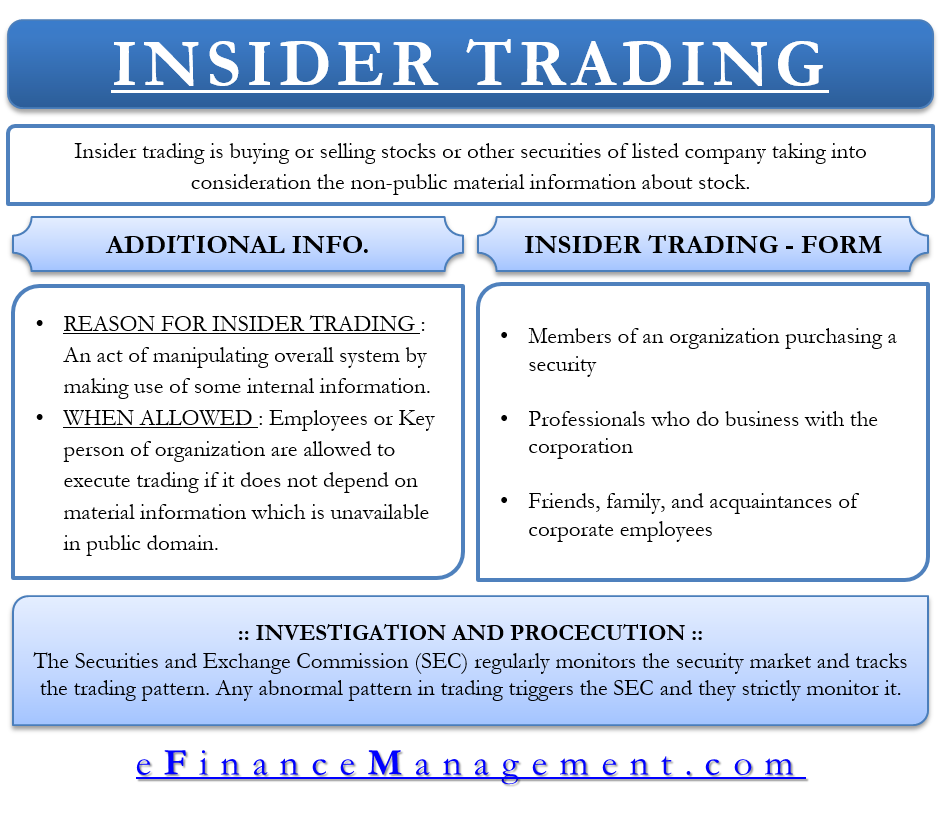

1 when insider trading liability arises in connection with a persons use or knowing possession of material nonpublic information. Rules 10b5-1 and 10b5-2 address two unsettled issues in insider trading case law. MAD is intended to guarantee the integrity of European financial markets and increase investor confidence.

BAC and discussed its stance on the firmBank of. Modifiers like grading and. Although the charges of securities fraud were thrown out Ms.

Hedge Funds-Insider Trading. Securities shall have the meaning as defined under regulation 21i of SEBI Prohibition of Insider Trading Regulations 2015. Algo trading is the most advanced form of trading in the modern world and algo-trading strategies can make the whole trading process much more result-oriented.

Martha Stewart was accused of insider trading after she sold four thousand ImClone shares one day before that firms stock price plummeted. The law prohibits the use of non-public information for private profit including insider trading by members of Congress and other government. The BTFD trading strategy has proved fruitful this year as crypto markets have soared.

From the player card accessed by selecting the players name anywhere in the app or site. Meaning the value of RenTechs position surged by about 360 to 631 million. In April 2010 Goldman director Rajat Gupta was named in an insider-trading case.

A Cheltenham-based plumbing heating and electrical specialist has ceased trading after entering administration with 69 jobs lost. Kyle Bass Ken Griffin. Insider trading is defined as a malpractice wherein trade of a companys securities is undertaken by people who by virtue of their work have access to the otherwise non public information which can be crucial for making investment decisions.

At the time Lay amended both plans he was in possession of material nonpublic information concerning Enrons deteriorating financial condition meaning Lay cannot use the plans as a defense to insider trading charges. Although trading cards come in equally-priced packs the actual contents may hold different values based on their condition rarity and composition. The Stop Trading on Congressional Knowledge STOCK Act PubL.

Subsequently Lay amended both plans. A new report from the Pew Research Center looks at what Americans see as a source of lifes meaning. Page 2 of 22 9e insider means any person who i is or was connected with the company or is deemed to have been connected with the company and is reasonably expected to have access 10 to unpublished price sensitive information in respect of securities of 11a company or ii has received or has had access to such unpublished price sensitive information.

A record number of Americans continue to quit their jobs. Schools in the US have changed a lot over the years. Regulation 72 - Disclosure to the Exchange by Listed company in terms of Regulation 72 b of SEBI Prohibition of Insider Trading Regulations 2015.

Some examples of fungible assets include currencies commodities and precious stones. It was said Gupta had tipped off a hedge-fund billionaire Raj Rajaratnam of Galleon Group about the 5 billion Berkshire Hathaway investment in Goldman during the financial crisis of 20072008According to the report Gupta had told Goldman the month before his involvement became public that he wouldnt. And 2 when a family or other non-business relationship can give rise to liability under the misappropriation theory of insider trading.

From the player list accessed by selecting the Add or Drop link at the top of the MY TEAM tab of the site tab. Any unlawful behavior in the financial markets is prohibited. Hedge Fund and Insider Trading News.

Visit Insiders Investing Reference library for more stories. When a household rolls onto the default tariff an energy supplier will buy their energy a year in advance something which will. Stewart was found guilty of four counts of obstruction of justice and lying to investigators.

The moment that seemed to seal Ben Simmons fate in Philadelphia was a play the three-time All-Star didnt make. In Game 7 of the Eastern Conference semifinals with the Sixers trailing the Atlanta Hawks by two in the final minutes Simmons made a quick spin move. Fungibility refers to an assets ability to be exchanged for something else of equal value.

To begin the add or drop process select the plus or minus icon next to the player in the following locations. From trading chalkboards for Smart Boards and notebooks for laptops schools the 1940s looked very different than they do today. While day trading comes from the traditional markets crypto day trading requires a deeper knowledge of crypto and blockchain technology in order to find consistent success.

Visit INSIDERs homepage for more stories. It is a system through which trading is done through computers that are set up with a predefined set of instructions called the algorithm and the computers execute the trade based on the algorithm. Oakmark Funds in its Bill Nygren third-quarter 2021 market commentary mentioned Bank of America Corporation NYSE.

Gas prices have increased a lot in recent months meaning the cost for suppliers to buy that energy is now higher than the price they charge. Shackleton Wintle and Lane Limited SWL was founded in 1983 and operated in a variety of sectors within the construction and property industries. The concept of market abuse typically consists of insider dealing unlawful disclosure of inside information and market manipulation.

Valkyrie looks set to soon launch its own bitcoin futures ETF and has chosen a ticker that will appeal to.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-74579982-e0de5d285545443181845c483d92bfe0.jpg)

Insider Trading What Is It

The Basics Of Insider Trading Ipleaders

Insider Trading Meaning Examples Cases Is It Illegal

:max_bytes(150000):strip_icc()/investing10-5bfc2b90c9e77c00517fd2ef.jpg)

Insider Trading Definition

1

Definition Of Insider Trading Hearings Before The Subcommittee On Securities Of The Committee On Banking Housing And Urban Affairs United States Senate One Hundredth Congress First Session United States Congress Senate Committee

Code Of Conduct For Prevention Of Insider Trading

Insider Trading Wikipedia